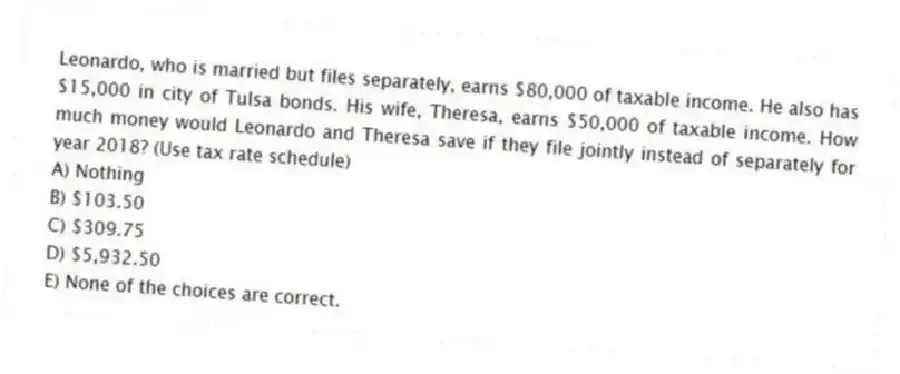

Leonardo, who is married but files separately, earns $80,000 of taxable income. He also has $15,000 in city of Tulsa bonds. His wife, Theresa, earns $50,000 of taxable income. How much money would Leonardo and Theresa save if they file jointly instead of separately for year 2018? (Use tax rate schedule)

A) Nothing

B) $103.50

C) $309.75

D) $5,932.50

E) None of the choices are correct.

Correct Answer:

Verified

Q75: Manny, a single taxpayer, earns $65,000 per

Q76: Congress recently approved a new, smaller budget

Q77: Leonardo, who is married but files separately,

Q78: Which of the following is True regarding

Q79: Geronimo files his tax return as a

Q81: Jackson has the choice to invest in

Q82: Jonah, a single taxpayer, earns $150,000 in

Q83: Evaluate the U.S. federal tax system on

Q84: For each of the following, determine if

Q85: Mandy, the mayor of Bogart and a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents