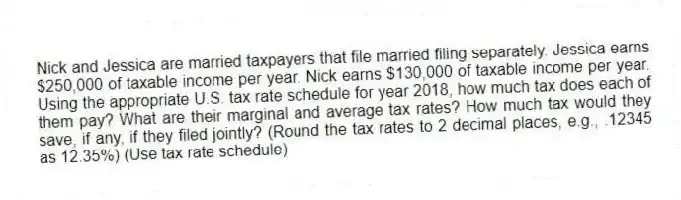

Nick and Jessica are married taxpayers that file married filing separately. Jessica earns $250,000 of taxable income per year. Nick earns $130,000 of taxable income per year. Using the appropriate U.S. tax rate schedule for year 2018, how much tax does each of them pay? What are their marginal and average tax rates? How much tax would they save, if any, if they filed jointly? (Round the tax rates to 2 decimal places, e.g., .12345 as 12.35%) (Use tax rate schedule)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: Nelson has the choice between investing in

Q104: Fred and Wilma, married taxpayers, earn $100,000

Q105: Consider the following tax rate structure. Is

Q106: Given the following tax structure, what amount

Q107: Given the following tax structure, what is

Q108: Given the following tax structure, what is

Q109: Congress would like to increase tax revenues

Q110: Consider the following tax rate structures. Is

Q111: Jed Clampett is expanding his family-run beer

Q112: Ariel invests $50,000 in a city of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents