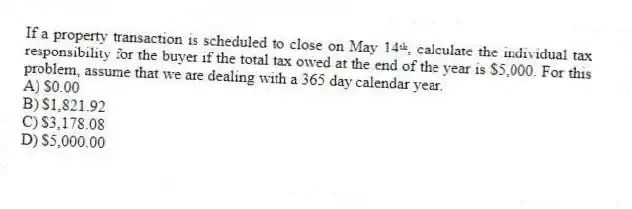

If a property transaction is scheduled to close on May 14ᵗʰ, calculate the individual tax responsibility for the buyer if the total tax owed at the end of the year is $5,000. For this problem, assume that we are dealing with a 365 day calendar year.

A) $0.00

B) $1,821.92

C) $3,178.08

D) $5,000.00

Correct Answer:

Verified

Q20: In certain circumstances, mutual assent between the

Q21: Suppose that you just sold a property

Q22: While many closings are conducted as a

Q23: Certain closing costs will be prorated to

Q24: When a borrower (the buyer) applies for

Q25: Since hazard insurance premiums are paid up-front,

Q27: Since property taxes are paid in arrears,

Q28: Which of the following contract elements is

Q29: Suppose that you decide to purchase a

Q30: When the seller in a contract for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents