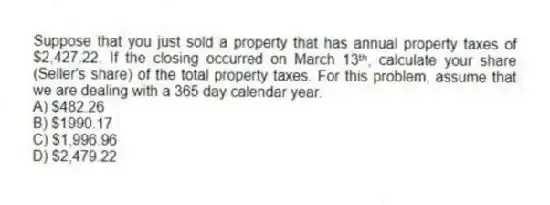

Suppose that you just sold a property that has annual property taxes of $2,427.22. If the closing occurred on March 13ᵗʰ, calculate your share (Seller's share) of the total property taxes. For this problem, assume that we are dealing with a 365 day calendar year.

A) $482.26

B) $1990.17

C) $1,996.96

D) $2,479.22

Correct Answer:

Verified

Q16: Both parties to a valid and enforceable

Q17: Any contract, whether it is for the

Q18: Recording documents in the public records informs

Q19: The laws of some states require that

Q20: In certain circumstances, mutual assent between the

Q22: While many closings are conducted as a

Q23: Certain closing costs will be prorated to

Q24: When a borrower (the buyer) applies for

Q25: Since hazard insurance premiums are paid up-front,

Q26: If a property transaction is scheduled to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents