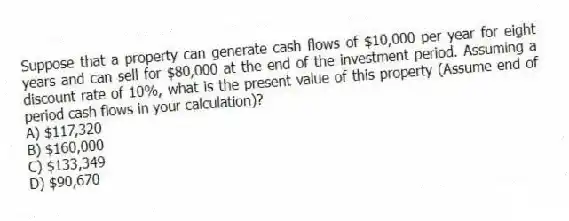

Suppose that a property can generate cash flows of $10,000 per year for eight years and can sell for $80,000 at the end of the investment period. Assuming a discount rate of 10%, what is the present value of this property (Assume end of period cash flows in your calculation) ?

A) $117,320

B) $160,000

C) $133,349

D) $90,670

Correct Answer:

Verified

Q23: Upon starting his first job after graduation,

Q24: Suppose a bank decides to make a

Q25: Suppose a bank decides to make a

Q26: Suppose you are starting a Ph.D. program

Q27: An investor originally paid $22,000 for a

Q29: Suppose you own a house that you

Q30: Suppose that an industrial building can be

Q31: Suppose an investor is interested in purchasing

Q32: Suppose an investor deposits $5,000 in an

Q33: Suppose an investor is interested in purchasing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents