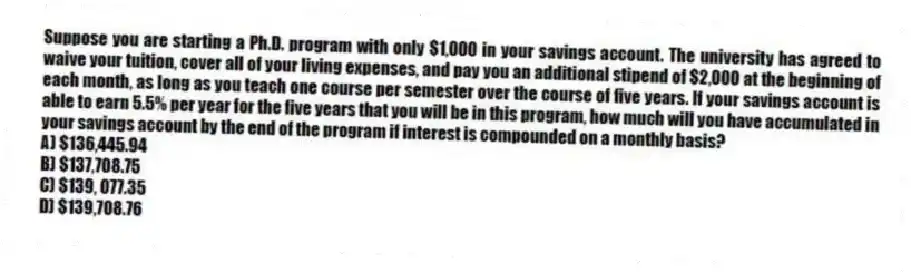

Suppose you are starting a Ph.D. program with only $1,000 in your savings account. The university has agreed to waive your tuition, cover all of your living expenses, and pay you an additional stipend of $2,000 at the beginning of each month, as long as you teach one course per semester over the course of five years. If your savings account is able to earn 5.5% per year for the five years that you will be in this program, how much will you have accumulated in your savings account by the end of the program if interest is compounded on a monthly basis?

A) $136,445.94

B) $137,708.75

C) $139, 077.35

D) $139,708.76

Correct Answer:

Verified

Q21: A property owner has set up a

Q22: An investor just purchased an office building

Q23: Upon starting his first job after graduation,

Q24: Suppose a bank decides to make a

Q25: Suppose a bank decides to make a

Q27: An investor originally paid $22,000 for a

Q28: Suppose that a property can generate cash

Q29: Suppose you own a house that you

Q30: Suppose that an industrial building can be

Q31: Suppose an investor is interested in purchasing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents