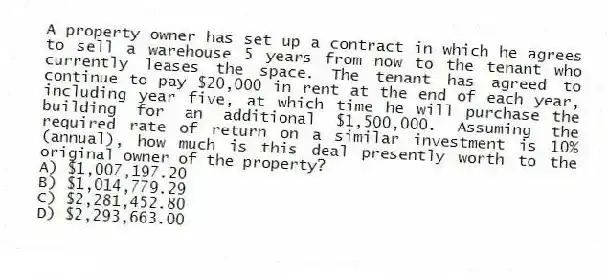

A property owner has set up a contract in which he agrees to sell a warehouse 5 years from now to the tenant who currently leases the space. The tenant has agreed to continue to pay $20,000 in rent at the end of each year, including year five, at which time he will purchase the building for an additional $1,500,000. Assuming the required rate of return on a similar investment is 10% (annual) , how much is this deal presently worth to the original owner of the property?

A) $1,007,197.20

B) $1,014,779.29

C) $2,281,452.80

D) $2,293,663.00

Correct Answer:

Verified

Q16: Assume that an individual puts $10,000 into

Q17: Assuming all else the same, the _

Q18: When discussing time-value-of-money it is necessary to

Q19: You have just had a tenant sign

Q20: Uncertainty of cash flows can vary significantly

Q22: An investor just purchased an office building

Q23: Upon starting his first job after graduation,

Q24: Suppose a bank decides to make a

Q25: Suppose a bank decides to make a

Q26: Suppose you are starting a Ph.D. program

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents