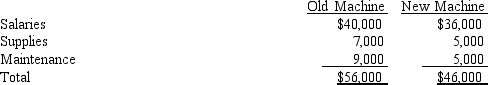

Dale Davis Company is evaluating a proposal to purchase a new machine that would cost $100,000 and have a salvage value of $10,000 in 4 years. It would provide annual operating cash savings of $10,000, as follows:

If the new machine is purchased, the old machine will be sold for its current salvage value of $20,000. If the new machine is not purchased, the old machine will be disposed of in 4 years at a predicted salvage value of $2,000. The old machine's present book value is $40,000. If kept, in 1 year the old machine will require repairs predicted to cost $35,000.

If the new machine is purchased, the old machine will be sold for its current salvage value of $20,000. If the new machine is not purchased, the old machine will be disposed of in 4 years at a predicted salvage value of $2,000. The old machine's present book value is $40,000. If kept, in 1 year the old machine will require repairs predicted to cost $35,000.

Dale Davis's cost of capital is 14%.

Required: Should the new machine be purchased? Why or why not?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q134: The reason that a discount factor in

Q136: Which of the following is true regarding

Q152: A series of equal future cash flows

Q155: Billings Office Services is considering the purchase

Q156: Figure 14-10.

Present value of $1

Q161: Figure 14-11.

Present value of an Annuity of

Q162: What are some reasons why firms use

Q163: Figure 14-10.

Present value of $1

Q170: Name two nondiscounting capital investment models. What

Q171: Which model is better for independent projects

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents