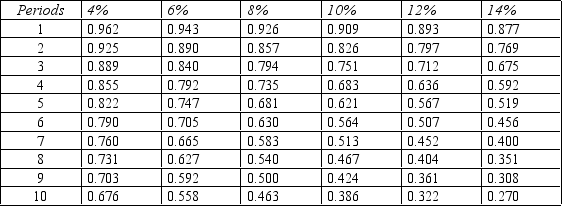

Figure 14-10.

Present value of $1

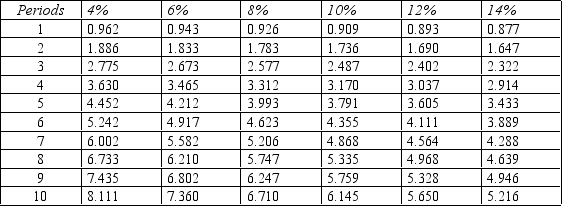

Present value of an Annuity of $1

Present value of an Annuity of $1

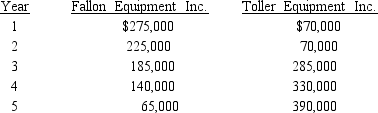

-Refer to Figure 14-10. Ray Corporation is looking to invest in a new piece of equipment. Two manufacturers of this type of equipment are being considered. After-tax inflows for the two competing projects are:

Both projects require an initial investment of $400,000. In both cases, assume that the equipment has a life of 5 years with no salvage value.

Both projects require an initial investment of $400,000. In both cases, assume that the equipment has a life of 5 years with no salvage value.

Required:

A. Assuming a discount rate of 8%, compute the net present value of each piece of equipment.

B. A third option is now available for a supplier outside of the country. The cost is also $400,000, but it will produce even cash flows over its 5-year life. What must the annual cash flow be for this equipment to be selected over the other two? Assume an 8% discount rate.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q134: The reason that a discount factor in

Q152: A series of equal future cash flows

Q160: Dale Davis Company is evaluating a proposal

Q161: Figure 14-11.

Present value of an Annuity of

Q162: What are some reasons why firms use

Q164: Which model of capital investment decision making

Q168: What is a capital investment decision? Give

Q168: Figure 14-10.

Present value of $1

Q170: Name two nondiscounting capital investment models. What

Q171: Which model is better for independent projects

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents