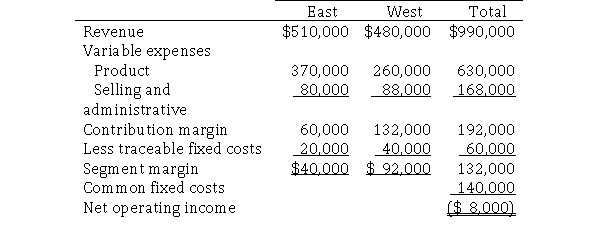

Nobles Corporation provided the following segment margin income statement for two of its divisions: East and West.  Nobles' actual weighted-average cost of capital is 10% and its tax rate is 30%.The East division balance sheet showed $300,000 of assets ($60,000 current and $240,000 long-term) and $320,000 of liabilities ($120,000 current and $200,000 long-term).The West division reported $360,000 of assets ($80,000 current and $280,000 long-term) and $260,000 of liabilities ($60,000 current and $200,000 long-term).

Nobles' actual weighted-average cost of capital is 10% and its tax rate is 30%.The East division balance sheet showed $300,000 of assets ($60,000 current and $240,000 long-term) and $320,000 of liabilities ($120,000 current and $200,000 long-term).The West division reported $360,000 of assets ($80,000 current and $280,000 long-term) and $260,000 of liabilities ($60,000 current and $200,000 long-term).

Required:

a.Calculate the economic value added for each division.

b.Which of the two managers will be rated higher on performance? Why?

Correct Answer:

Verified

Ea...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q166: An organization may be structured as a

Q167: Nobles Corporation provided the following income statement

Q168: Bethlehem Corporation had $1,000,000 in sales which

Q169: Jackson Brothers Instruments sells stringed instruments.Trent Jackson,

Q170: In a decentralized organization, upper managers need

Q172: Springer Company produces and sells home-ground wheat

Q173: Logan Corporation reported the following operating data

Q174: The Transformer division of Lorman Industries produces

Q175: In a decentralized organization, upper managers need

Q176: The Logan Company reported the following operating

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents