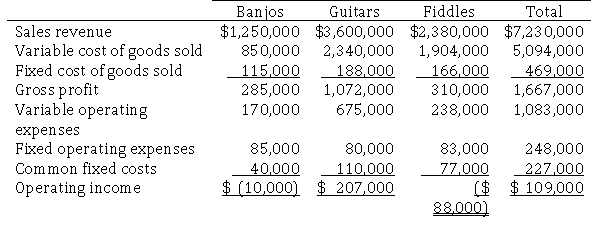

Jackson Brothers Instruments sells stringed instruments.Trent Jackson, the company's president, just received the following income statement reporting the results of the past year.  Trent is concerned that two of the company's divisions are showing a loss, and he wonders if the company should stop selling Banjos and Fiddles to concentrate solely on guitars.

Trent is concerned that two of the company's divisions are showing a loss, and he wonders if the company should stop selling Banjos and Fiddles to concentrate solely on guitars.

Required:

a.Prepare a segment margin income statement.Omit the heading.Fixed cost of goods sold and fixed operating expenses can be traced to each division.

b.Should Trent close the banjos and fiddles divisions? Why or why not?

c.Trent wants to change the allocation method used to allocate common fixed costs to the divisions.His plan is to allocate these costs based on sales revenue.Will this new allocation method change your decision on whether to close the guitars and fiddles divisions? Why or why not?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q164: Bethel Corporation provided the following income statement

Q165: The Assembly Division of Mounds Corporation makes

Q166: An organization may be structured as a

Q167: Nobles Corporation provided the following income statement

Q168: Bethlehem Corporation had $1,000,000 in sales which

Q170: In a decentralized organization, upper managers need

Q171: Nobles Corporation provided the following segment margin

Q172: Springer Company produces and sells home-ground wheat

Q173: Logan Corporation reported the following operating data

Q174: The Transformer division of Lorman Industries produces

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents