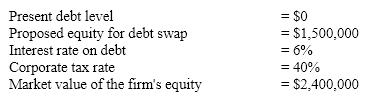

Assume the following selected financial information about a firm that is about to restructure capital by exchanging equity for debt:

a. If the firm operates in the world of the Modigliani-Miller model with taxes but without bankruptcy costs what would be the market value of its equity after the restructuring?

a. If the firm operates in the world of the Modigliani-Miller model with taxes but without bankruptcy costs what would be the market value of its equity after the restructuring?

b. By how much would the firm's total value and therefore shareholder wealth increase as a result of the swap? Explain.

c. Would we be able to answer the questions in part a and b precisely in the MM model with taxes and bankruptcy costs? Why?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q188: Operating leverage increases as the proportion of

Q189: A firm with a capital structure with

Q190: Leverage adds variability to financial performance when

Q191: Modgliani and Miller's mathematical model included a

Q192: The EBIT-EPS analysis provides a means for

Q193: Hamming & Heim Corp's capital of $3,000,000

Q194: Managers seeking an optimal capital structure face

Q195: General guidelines for managers regarding capital structure

Q196: Typically, firms with a higher degree of

Q198: Southern Inc. has EBIT of $3,500,000, and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents