Southern Inc. has EBIT of $3,500,000, and total capital of $20,000,000 that is 15% debt. There are 1,700,000 shares of stock outstanding which sell at book value. The firm pays 10% interest on its debt and is subject to a combined state and federal tax rate of 40%. Southern plans to restructure its capital to 60% debt.

a. Make a simple calculation that indicates whether at the current level of profitability more debt will enhance results? Draw a conclusion in fifteen words or less.

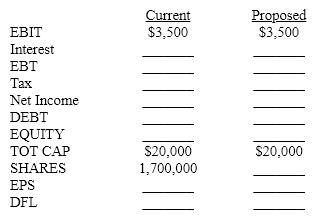

b. Calculate EPS, and DFL at the current and proposed structures using the following worksheet:

($000 except for EPS, DFL and Shares)

c. Use your results to point out two conflicting influences the change will have on stock price.

c. Use your results to point out two conflicting influences the change will have on stock price.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q188: Operating leverage increases as the proportion of

Q189: A firm with a capital structure with

Q190: Leverage adds variability to financial performance when

Q191: Modgliani and Miller's mathematical model included a

Q192: The EBIT-EPS analysis provides a means for

Q193: Hamming & Heim Corp's capital of $3,000,000

Q194: Managers seeking an optimal capital structure face

Q195: General guidelines for managers regarding capital structure

Q196: Typically, firms with a higher degree of

Q197: Assume the following selected financial information about

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents