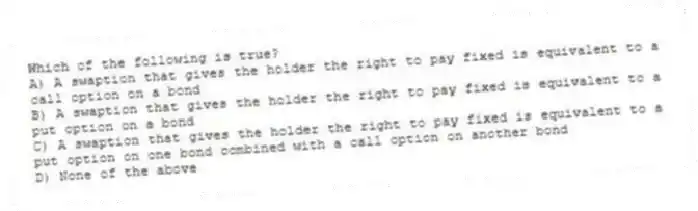

Which of the following is true?

A) A swaption that gives the holder the right to pay fixed is equivalent to a call option on a bond

B) A swaption that gives the holder the right to pay fixed is equivalent to a put option on a bond

C) A swaption that gives the holder the right to pay fixed is equivalent to a put option on one bond combined with a call option on another bond

D) None of the above

Correct Answer:

Verified

Q1: A Eurodollar futures option contract has a

Q2: Which of the following is assumed to

Q3: In a floor with semiannual reset dates,

Q4: A ten year interest rate cap has

Q5: A Eurodollar futures option contract has a

Q7: A floating-rate borrower wants to use a

Q8: The price of a December put futures

Q9: In put-call parity for caps and floors,

Q10: What is exchanged when a put option

Q11: A five-year cap is reset annually period.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents