Use This Information to Answer the Following Questions -Use the Sensitivity Report to Answer the Following Questions:

A

Use this information to answer the following questions.

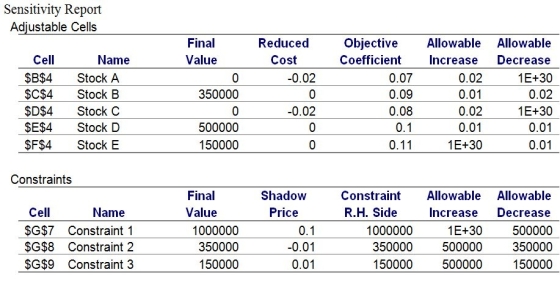

An investment company currently has $1 million available for investment in five different stocks.The company wants to maximize the interest earned over the next year.The five investment possibilities along with the expected interest earned are shown below.To manage risk,the investment firm wishes to have at least 35% of the investment in stocks A and B.Furthermore,no more than 15% of the investment may be in stock E.

-Use the Sensitivity Report to answer the following questions:

a.What would be the impact on the optimal allocation if the expected interest earned on stock A decreases to 6%?

b.What would be the impact on the optimal allocation if the expected interest earned on stock A increases to 10%?

c.What should the minimal expected interest earned for stock C be before it would be desirable to invest in this particular stock?

d.What would be the impact on the optimal allocation and the objective function value if the expected interest earned on stock B decreases by 1%?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q27: Use this information to answer the

Q28: The information provided in the Sensitivity Report

Q29: A constraint right-hand side value is increased

Q30: Use this information to answer the

Q31: The Sensitivity Report has two parts: one

Q33: Use this information to answer the

Q34: A binding constraint means that the constraint

Q35: Use this information to answer the

Q36: The slack of a constraint indicates the

Q37: Use this information to answer the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents