Use This Information to Answer the Following Questions -Use the Sensitivity Report to Answer the Following Questions:

A

Use this information to answer the following questions.

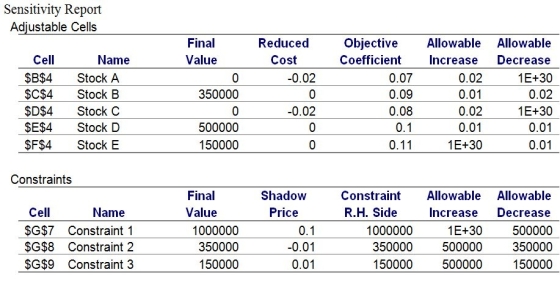

An investment company currently has $1 million available for investment in five different stocks.The company wants to maximize the interest earned over the next year.The five investment possibilities along with the expected interest earned are shown below.To manage risk,the investment firm wishes to have at least 35% of the investment in stocks A and B.Furthermore,no more than 15% of the investment may be in stock E.

-Use the Sensitivity Report to answer the following questions:

a.Suppose that the amount of money available for investment increases by $50,000.What impact would this have on the current optimal objective function value?

b.Suppose that total investment in stocks A and B must be at least 40% of the total amount available for investment (i.e. ,$400,000).What impact would this have on the current optimal objective function value?

c.Suppose that the total investment in stocks A and be must be at least 30% of the total amount available for investment.What impact would this have on the current optimal objective function value?

d.Assume that no more than 30% of the investment may be in stock E.What impact would this have on the current optimal objective function value?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q32: Use this information to answer the

Q33: Use this information to answer the

Q34: A binding constraint means that the constraint

Q35: Use this information to answer the

Q36: The slack of a constraint indicates the

Q38: Use this information to answer the

Q39: Surplus is typically associated with "≤" constraints.

Q40: The Reduced Cost may be viewed as

Q41: Use the information below to answer the

Q42: Use the information below to answer the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents