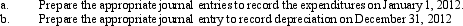

Whiting Company purchased a machine in 2007 for $150,000. The machine was being depreciated by the straight-line method over an estimated useful life of 10 years, with no salvage value. At the beginning of 2012, after 5 years of use, Whiting paid $30,000 on maintenance to the machine. Whiting determined that $5,000 of this expense was normal maintenance and did not extend the life of the machine. However, the rest of the expenditure was an overhaul of the machine and was expected to extend the machine's estimated useful life by an additional 5 years. What would be the depreciation expense recorded for the above machine in 2012?

Correct Answer:

Verified

Q120: Ferrott Company purchased a machine that was

Q121: Sylvia Supply Company, a calendar-year corporation, purchased

Q122: Smolan Company purchased a new machine on

Q123: In 2002, Yates Company purchased land and

Q124: On July 1, 2011, Macro Inc. purchased

Q125: On May 1, 2011, Dominquez Inc. purchased

Q127: Mini Computers purchased a delivery truck 4

Q128: Thayer Company's financial statements on December 31,

Q129: On January 1, 2011, Milner Company purchased

Q130: The following information is for Brown Company:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents