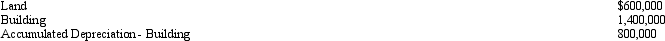

In 2002, Yates Company purchased land and a building at a cost of $2,000,000, with $600,000 allocated to land and $1,400,000 to the building. On December 31, 2011, the accounting records showed the following:

During 2012, it is determined that the building is on the site of a toxic waste dump and the future cash flows associated with the land and building are less than the recorded total book value for these two assets. The fair value of the land and building is $200,000, of which $60,000 is land. Make any journal entries necessary to record the asset impairment.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q118: Belpre Inc. constructed a new office building.

Q119: Trans-State Movers purchased a truck on January

Q120: Ferrott Company purchased a machine that was

Q121: Sylvia Supply Company, a calendar-year corporation, purchased

Q122: Smolan Company purchased a new machine on

Q124: On July 1, 2011, Macro Inc. purchased

Q125: On May 1, 2011, Dominquez Inc. purchased

Q126: Whiting Company purchased a machine in 2007

Q127: Mini Computers purchased a delivery truck 4

Q128: Thayer Company's financial statements on December 31,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents