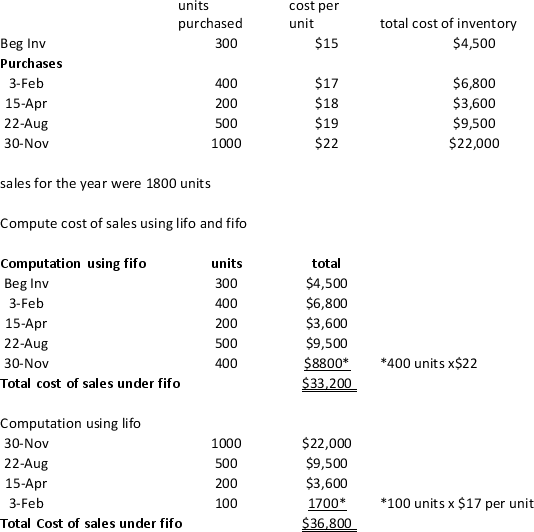

The following schedule was taken out of the inventory records for the Happy Dog Company

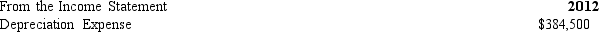

-The following information is available from Sheldon Corp.:

Use the information above to calculate the following: a.Average age of the depreciable assets

b.Average remaining useful life of the depreciable assets

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q65: Firm A places its order for the

Q75: Firm D holds 20,000 gallons of chemicals

Q78: Explain the difference between a temporary and

Q84: Magnum Construction contracted to construct a

Q85: The following information is related to the

Q86: The following information is taken from Satin

Q88: A large manufacturer recently changed its cost-flow

Q89: Global,Inc.provides consulting services throughout the world.The company

Q90: What are the foiur disclosures required by

Q92: Cooke Industries imports and sells quality

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents