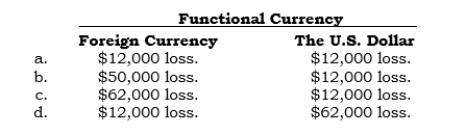

_____ On 12/31/06, Polex's payable to a foreign vendor was properly reported at $512,000 in its balance sheet after recording a $12,000 upward adjustment as a result of a change in the exchange rate. On 1/7/07, the settlement required $505,000. Also, Polex owns a foreign subsidiary. For 2006, an adverse result of $50,000 occurred in translation or remeasurement (as appropriate) for this subsidiary. What amount should be reported in the 2006 consolidated income statement under each of the following situations?

Correct Answer:

Verified

Q119: _ A foreign subsidiary has provided the

Q120: _ A foreign subsidiary has provided the

Q121: _ Following are certain items (accounts or

Q122: _ Following are certain items (accounts or

Q123: _ On 12/31/06, Polbex's payable to a

Q125: _ On 11/11/06, Puzco sold inventory costing

Q126: _ Parco's German subsidiary is Sarco. On

Q127: _ Paxco has a British subsidiary, Saxco.

Q128: Indicate which of the following exchange rates

Q129: A domestic company's 100%-owned foreign subsidiary located

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents