A domestic company's 100%-owned foreign subsidiary located in Great Britain had stockholders' equity of 500,000 pounds at 1/1/06. During 2006, the subsidiary (whose functional currency is the pound) reported net income of 300,000 pounds. On 11/30/06, the subsidiary declared and paid a dividend of 100,000 pounds.

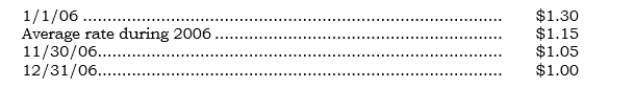

Direct exchange rate information follows:

Required:

Required:

Calculate the 2006 translation adjustment.

Correct Answer:

Verified

Q124: _ On 12/31/06, Polex's payable to a

Q125: _ On 11/11/06, Puzco sold inventory costing

Q126: _ Parco's German subsidiary is Sarco. On

Q127: _ Paxco has a British subsidiary, Saxco.

Q128: Indicate which of the following exchange rates

Q130: A domestic company's 100%-owned foreign subsidiary located

Q131: Various data for Jackson Corporation's overseas subsidiaries

Q132: A foreign subsidiary has provided the following

Q133: General Computers Company owns a foreign subsidiary

Q134: A foreign subsidiary has provided the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents