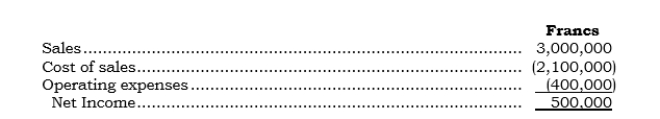

A domestic company's 100%-owned foreign subsidiary located in Switzerland submitted the following income statement for 2006:

Additional information:

Additional information:

a. Inventory decreased 100,000 francs during 2006.

b. Sales, purchases, and operating expenses occurred or were incurred evenly throughout the year. (Operating expenses include depreciation expense of 100,000 francs.)

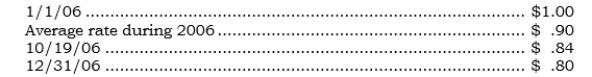

c. The subsidiary, whose functional currency is the U.S. dollar, had at the beginning of 2006 monetary assets of 1,000,000 francs, monetary liabilities of 700,000 Swiss francs, and stockholders' equity of 1,500,000 Swiss francs.

d. On 10/19/06, the subsidiary declared and paid a cash dividend of 200,000 Swiss francs.

e. Cash disbursements for 2006 were 2,500,000 francs.

f. Direct exchange rate information follows:

Required:

Required:

Calculate the 2006 foreign currency transaction gain or loss arising from the change in the exchange rate.

Correct Answer:

Verified

Q125: _ On 11/11/06, Puzco sold inventory costing

Q126: _ Parco's German subsidiary is Sarco. On

Q127: _ Paxco has a British subsidiary, Saxco.

Q128: Indicate which of the following exchange rates

Q129: A domestic company's 100%-owned foreign subsidiary located

Q131: Various data for Jackson Corporation's overseas subsidiaries

Q132: A foreign subsidiary has provided the following

Q133: General Computers Company owns a foreign subsidiary

Q134: A foreign subsidiary has provided the following

Q135: Following are certain items (accounts or account

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents