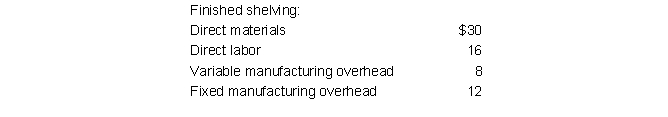

The Timberland Lumber Company had the following historical accounting data, per 100 board feet, concerning one of its products in the Sawmill Division: The historical data is based on an average volume per period of 20,000 board feet. The shelving is normally transferred internally from the Sawmill Division to the Finishing Division. Timberland may also sell the shelving externally for $90 per 100 board feet. The divisions are taxed at identical rates.

The historical data is based on an average volume per period of 20,000 board feet. The shelving is normally transferred internally from the Sawmill Division to the Finishing Division. Timberland may also sell the shelving externally for $90 per 100 board feet. The divisions are taxed at identical rates.

Which of the following transfer pricing methods would lead to the highest Finishing Division income if 10,000 board feet are produced and transferred in entirety this period from Sawmill to Finishing?

A) Market price

B) All variable costs plus 50 percent markup

C) Full absorption costing plus 10 percent markup

D) None of these methods generates a higher division income than another.

Correct Answer:

Verified

Q18: Costs that would not be incurred if

Q19: Product X contribution margin minus Direct product

Q20: Assume the following information for a product

Q21: Assume the following information for a product

Q22: An advantage of absorption cost transfer pricing

Q24: Illinois Mower Manufacturing Company has three divisions.

Q25: All of the following reasons are legitimate

Q26: What is a transfer price?

A) The amount

Q27: Which of the following situations gives rise

Q28: The optimal transfer price from the corporation's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents