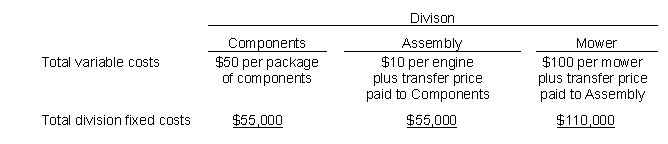

Illinois Mower Manufacturing Company has three divisions. Engine components are transferred from Components to Assembly. Assembled engines are transferred from Assembly to the Mower Division. Costs for each division are given below. Mowers are sold on a competitive outside market for $125. There are no outside markets for engine components or assembled engines. This period, Components sends Assembly 5,000 packages of engine components.

This period, Components sends Assembly 5,000 packages of engine components.

Using a market based transfer price, determine the amount Assembly would pay Components:

A) Cannot be determined from the information provided

B) Is based on the Component's division's variable cost

C) Is based on the Component's division's full absorption cost

D) Is the $125 market price of the mowers

Correct Answer:

Verified

Q19: Product X contribution margin minus Direct product

Q20: Assume the following information for a product

Q21: Assume the following information for a product

Q22: An advantage of absorption cost transfer pricing

Q23: The Timberland Lumber Company had the following

Q25: All of the following reasons are legitimate

Q26: What is a transfer price?

A) The amount

Q27: Which of the following situations gives rise

Q28: The optimal transfer price from the corporation's

Q29: When an outside market exists for an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents