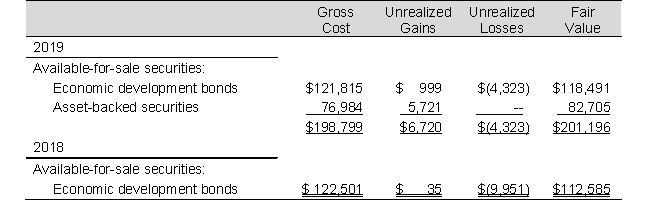

Following is a portion of the investments footnote from Urban Company's 2019 annual report.

Required

Required

a. At what amount does Urban report its available-for-sale securities on its balance sheets for 2019 and 2018?

b. How does Urban's account for its trading securities? How does the accounting differ from their accounting method for available-for-sale?

c. What are the net unrealized gains (losses) for 2019 and 2018? How did these unrealized gains (losses) affect the company's reported income in 2019 and 2018?

d. What is the difference between realized and unrealized gains and losses? Are realized gains and losses treated differently in the income statement than unrealized gains and losses for the available-for-sale securities?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: On October 1, Gordon Company purchased $100,000

Q20: A bond investment purchased at a discount:

A)

Q21: Crane Company purchases an investment in Windall

Q22: The following is from the financial statement

Q23: On January 1, Jackson acquired common stock

Q24: Golden Company purchases equity securities in Leash

Q25: On January 1, Barn Corporation acquired common

Q26: Jake Corporation purchases an investment in Dempsey,

Q27: On January 1, 2019, East Company acquired

Q28: A recent annual report of Fargo Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents