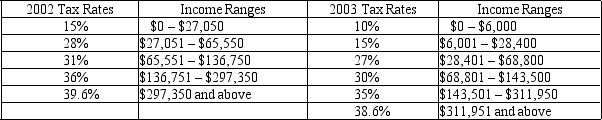

Table 12-2

United States Income Tax Rates for a Single Individual, 2002 and 2003.

-Refer to Table 12-2.What type of tax structure did the United States have in 2002 for single individuals?

A) a proportional tax structure

B) a regressive tax structure

C) a progressive tax structure

D) a lump-sum tax structure

Correct Answer:

Verified

Q110: Table 12-2

United States Income Tax Rates for

Q118: Table 12-2

United States Income Tax Rates for

Q151: One tax system is less efficient than

Q158: An efficient tax system is one that

Q186: Deadweight losses represent the

A) inefficiency that taxes

Q187: In the absence of taxes,Janet would prefer

Q281: A tax system with little deadweight loss

Q307: When taxes are imposed on a commodity,

A)there

Q315: An optimal tax is one that minimizes

Q366: Part of the administrative burden of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents