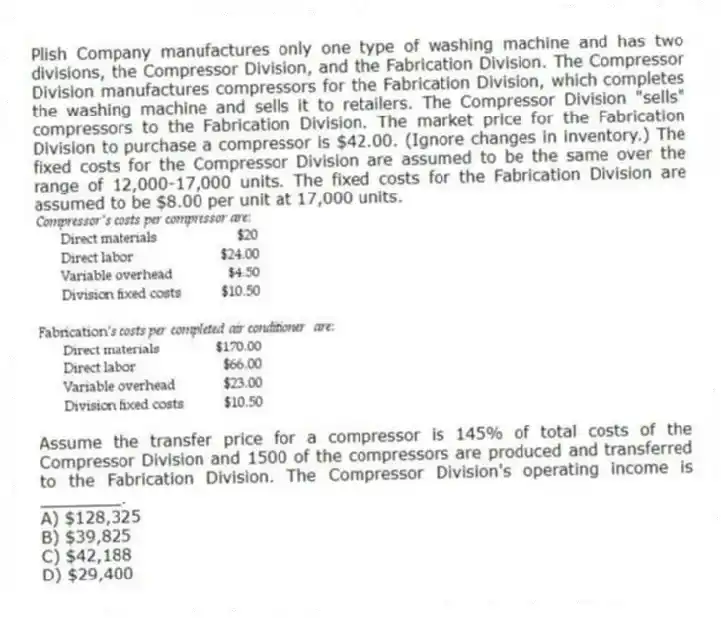

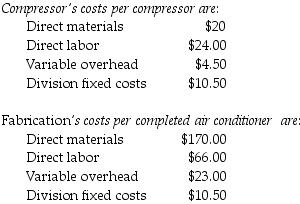

Plish Company manufactures only one type of washing machine and has two divisions, the Compressor Division, and the Fabrication Division. The Compressor Division manufactures compressors for the Fabrication Division, which completes the washing machine and sells it to retailers. The Compressor Division "sells" compressors to the Fabrication Division. The market price for the Fabrication Division to purchase a compressor is $42.00. (Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 12,000-17,000 units. The fixed costs for the Fabrication Division are assumed to be $8.00 per unit at 17,000 units.

Assume the transfer price for a compressor is 145% of total costs of the Compressor Division and 1500 of the compressors are produced and transferred to the Fabrication Division. The Compressor Division's operating income is ________.

A) $128,325

B) $39,825

C) $42,188

D) $29,400

Correct Answer:

Verified

Q66: Plish Company manufactures only one type of

Q67: Transfer prices do not affect managers whose

Q68: Division A sells ground veal internally to

Q69: Timekeeper Corporation has two divisions, Distribution and

Q70: Division A sells ground veal internally to

Q72: Branded Shoe Company manufactures only one type

Q73: Hybrid transfer prices take into account both

Q74: Branded Shoe Company manufactures only one type

Q75: Hybrid transfer prices can be arrived at

Q76: Plish Company manufactures only one type of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents