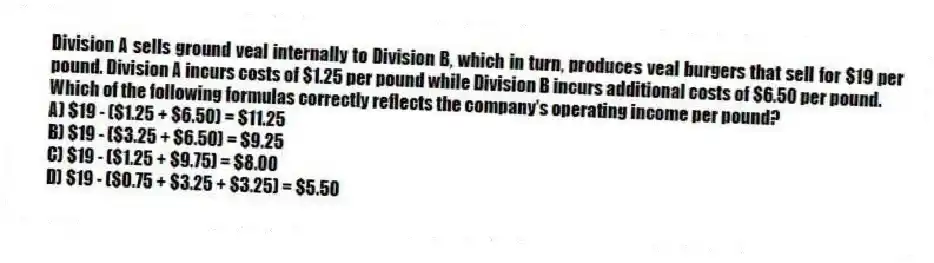

Division A sells ground veal internally to Division B, which in turn, produces veal burgers that sell for $19 per pound. Division A incurs costs of $1.25 per pound while Division B incurs additional costs of $6.50 per pound.

Which of the following formulas correctly reflects the company's operating income per pound?

A) $19 - ($1.25 + $6.50) = $11.25

B) $19 - ($3.25 + $6.50) = $9.25

C) $19 - ($1.25 + $9.75) = $8.00

D) $19 - ($0.75 + $3.25 + $3.25) = $5.50

Correct Answer:

Verified

Q63: Branded Shoe Company manufactures only one type

Q64: Timekeeper Corporation has two divisions, Distribution and

Q65: Branded Shoe Company manufactures only one type

Q66: Plish Company manufactures only one type of

Q67: Transfer prices do not affect managers whose

Q69: Timekeeper Corporation has two divisions, Distribution and

Q70: Division A sells ground veal internally to

Q71: Plish Company manufactures only one type of

Q72: Branded Shoe Company manufactures only one type

Q73: Hybrid transfer prices take into account both

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents