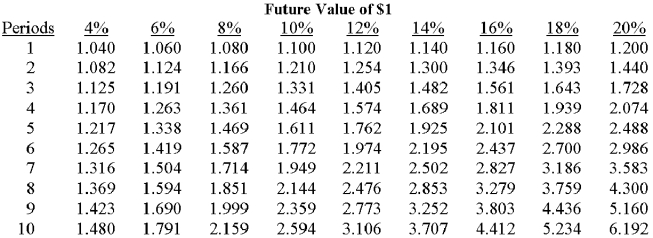

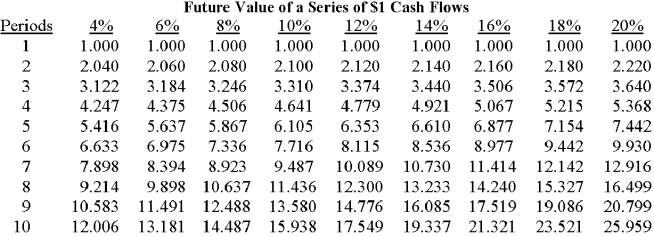

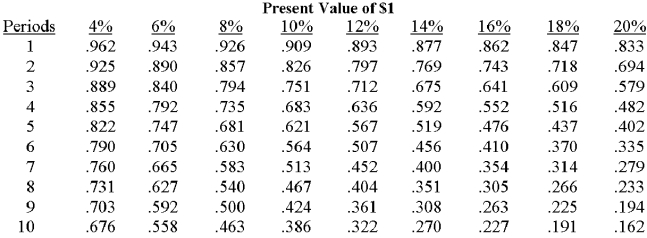

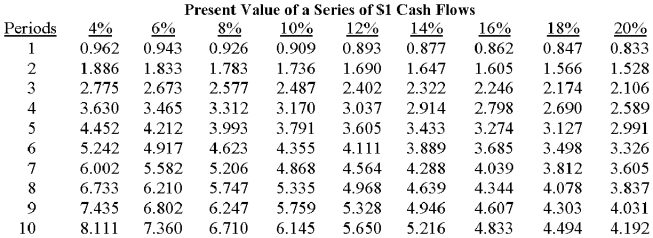

A new asset is expected to provide service over the next four years.It will cost $500,000,generates annual cash inflows of $150,000,and requires cash operating expenses of $30,000 each year.In addition,a $10,000 overhaul will be needed in year 3.If the company requires a 10% rate of return,the net present value of this machine would be:

A) $(127,110) ,and the machine meets the company's rate-of-return requirement.

B) $(127,110) ,and the machine does not meet the company's rate-of-return requirement.

C) $(129,600) ,and the machine does not meet the company's rate-of-return requirement.

D) $(151,700) ,and the machine meets the company's rate-of-return requirement.

E) some other amount.

Correct Answer:

Verified

Q28: Q29: Q30: If income taxes are ignored,which of the Q31: Q35: Q36: The systematic follow-up on a capital project Q37: A company's hurdle rate is generally influenced Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()

![]()