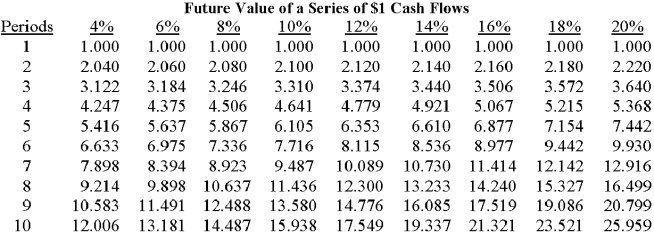

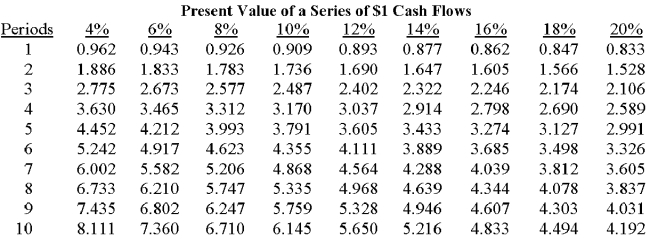

Paulsen is considering the acquisition of a $217,750 machine that is expected to produce annual savings in cash operating costs of $50,000 over the next six years.If Paulsen uses the internal rate of return (IRR) to evaluate new investments and the company has a hurdle rate of 12%,which of the following statements is correct?

A) The machine's IRR is less than 4%,and the machine should not be acquired.

B) The machine's IRR is approximately 10%,and the machine should not be acquired.

C) The machine's IRR is approximately 10%,and the machine should be acquired.

D) The machine's IRR is approximately 12%,and the machine should be acquireD.

E) All of the preceding statements are falsE.

Correct Answer:

Verified

Q24: Which of the following choices correctly states

Q25: Which of the following choices correctly states