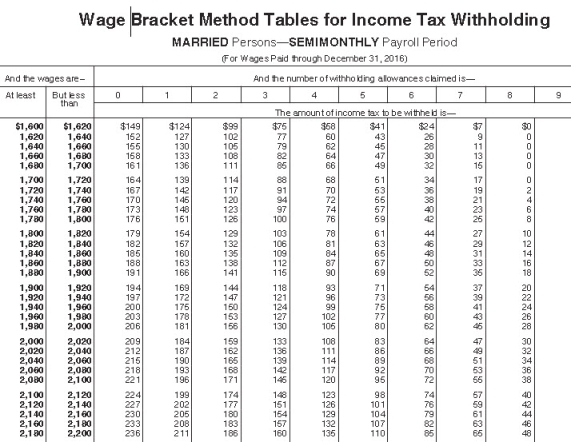

Brent is a full-time exempt employee in Clark County,Indiana.He earns an annual salary of $48,000 and is paid semimonthly.He is married with 3 withholding allowances.His state income tax per pay period is $57.38,and Clark County income tax is $33.75 per pay period.What is the total of FICA,federal,state,and local deductions per pay period,assuming no Pre-Tax Deductions? (Use the wage-bracket table to determine federal taxes.Do not round intermediate calculations,only round final answer to two decimal points. )

A) $369.36

B) $306.13

C) $325.13

D) $374.13

Correct Answer:

Verified

Q44: Why do employers use checks as an

Q44: Janna is a salaried nonexempt employee in

Q44: Jesse is a part-time nonexempt employee in

Q45: Manju is a full-time exempt employee living

Q47: Best practices for paying employees by check

Q49: Tierney is a full-time nonexempt salaried employee

Q51: From the employer's perspective,which of the following

Q51: Collin is a full-time exempt employee in

Q53: Which of the following is true about

Q53: Amanda is a full-time exempt employee in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents