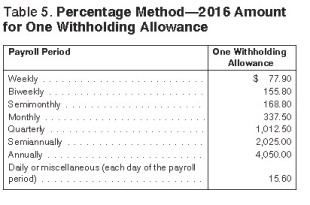

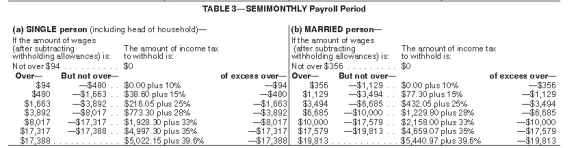

Collin is a full-time exempt employee in Juneau,Alaska,who earns $135,000 annually and has not yet reached the Social Security wage base.He is single with 1 withholding allowance and is paid semimonthly.He contributes 3% per pay period to his 401(k) and has pre-tax health insurance and AFLAC deductions of $150 and $25,respectively.Collin has a child support garnishment of $300 per pay period.What is his net pay? (Use the percentage method.Do not round interim calculations,only round final answer to two decimal points. )

A) $3,353.05

B) $3,449.30

C) $3,274.60

D) $3,585.14

Correct Answer:

Verified

Q44: Why do employers use checks as an

Q47: Best practices for paying employees by check

Q48: Brent is a full-time exempt employee in

Q49: Tierney is a full-time nonexempt salaried employee

Q51: From the employer's perspective,which of the following

Q53: Which of the following is true about

Q53: Amanda is a full-time exempt employee in

Q54: Danny is a full-time exempt employee in

Q56: Vivienne is a full-time exempt employee in

Q58: Maile is a full-time exempt employee in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents