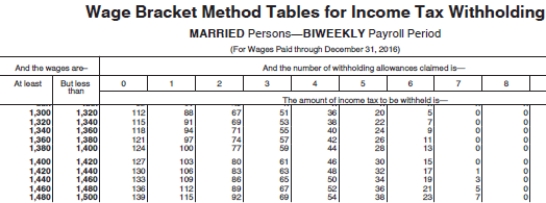

Vivienne is a full-time exempt employee in DeKalb County,Indiana,and is paid biweekly.She earns $39,000 annually,and is married with 2 withholding allowances.Her state income tax deduction is $44.46,and the DeKalb County income tax deduction is $19.62.What is the total amount of her FICA,federal,state,and local taxes per pay period,assuming no Pre-Tax Deductions? (Use the wage-bracket table to determine the federal tax deduction.Do not round intermediate calculations,only round final answer to two decimal points. )

A) $239.83

B) $320.83

C) $265.83

D) $270.83

Correct Answer:

Verified

Q45: Which of the following payment methods is

Q46: Why might an employee elect to have

Q48: What is an advantage of direct deposit

Q49: What is a disadvantage to using paycards

Q51: Collin is a full-time exempt employee in

Q53: Amanda is a full-time exempt employee in

Q53: Which of the following is true about

Q54: Danny is a full-time exempt employee in

Q58: Maile is a full-time exempt employee in

Q61: The purpose of the wage base used

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents