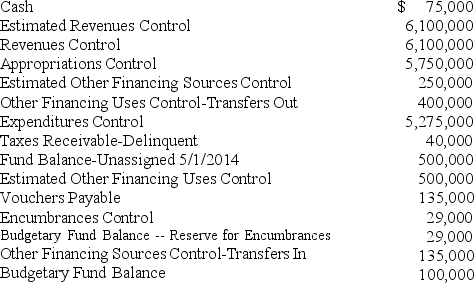

The City of Morganville had the following pre-closing account balances in its General Fund as of April 30,2015. Debits and credits are not separated; each account had its "normal" balance. Among the expenditures recorded this year is an amount expended on supplies ordered at the end of the previous year. Assume that encumbrances do not lapse and that the City failed to make the journal entry(s)necessary to re-establish the encumbrance in the current year.

Required:

(a)Prepare all entries necessary to close the General Fund of the City of Morganville.

(b)Prepare a Statement of Revenues,Expenditures,and Changes in Fund Balance for the General Fund for the City of Morganville for the Year Ended April 30,2015. End with the ending fund balance. This is the GAAP operating statement.

Correct Answer:

Verified

Q115: The expenditures account equals the amount of

Q116: $60,000 of property tax owed to the

Q117: Governmental fund financial statements are to be

Q117: Prepare entries in general journal form to

Q119: What is the different accounting treatment with

Q120: Interfund Transfers are flows of cash or

Q121: The following information was available for the

Q122: Center City's General Fund has the following

Q123: The City of Smithville was awarded a

Q128: What is the difference between reciprocal interfund

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents