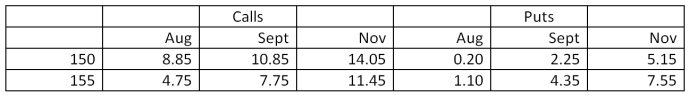

Suppose you purchase the November call option on orange juice futures with a strike price of 150 at the price shown in the table below. What will be your profit or loss on this contract if the price of orange juice futures is $0.616 per pound at expiration of the option contract?

Futures Options

Orange juice:

15,000 lbs, U.S. cents per lb.

A) loss of $2,107.50

B) loss of $1,717.50

C) no profit or loss

D) profit of $1,717.50

E) profit of $2,107.50

Correct Answer:

Verified

Q61: What are the primary motives for a

Q61: Suppose you purchase a September cocoa futures

Q62: How much will you pay to purchase

Q64: Suppose you sell nine September silver futures

Q64: Explain how a manufacturer who has an

Q65: Explain both the concept of financial engineering

Q66: Explain why a swap is effectively a

Q67: What is cross-hedging?

Why do you suppose

Q68: Suppose your firm produces breakfast cereal and

Q69: Suppose a financial manager buys call options

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents