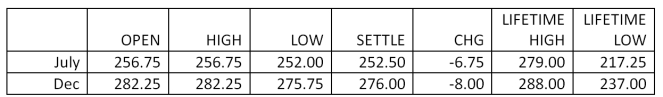

Suppose your firm produces breakfast cereal and needs 65,000 bushels of corn in December for an upcoming promotion. You would like to lock in your costs today because you are concerned that corn prices might go up between now and December. To hedge your risk exposure, you could purchase corn futures contracts today effectively locking in a total settlement price of _____, based on the closing price shown in the table below. Futures:

Corn - 5,000 bu., U.S. cents per bu.

A) $163,800

B) $164,125

C) $174,238

D) $179,400

E) $183,463

Correct Answer:

Verified

Q61: What are the primary motives for a

Q61: Suppose you purchase a September cocoa futures

Q62: How much will you pay to purchase

Q64: Suppose you sell nine September silver futures

Q64: Explain how a manufacturer who has an

Q65: Explain both the concept of financial engineering

Q66: Explain why a swap is effectively a

Q67: What is cross-hedging?

Why do you suppose

Q69: Suppose a financial manager buys call options

Q70: Suppose you purchase the November call option

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents