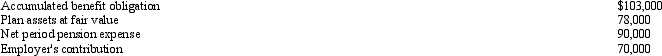

Gorilla,Corp.implemented a defined-benefit pension plan for its employees on January 2,2012.The following data are provided for year 2012,as of December 31,2012.  What amount should Gorilla record as additional minimum pension liability at December 31,2012?

What amount should Gorilla record as additional minimum pension liability at December 31,2012?

A) $0

B) $5,000

C) $20,000

D) $45,000

Correct Answer:

Verified

Q1: To calculate a company's average tax rate

Q3: Falcon Networks Falcon Networks is a leading

Q7: The major difference between accounting for pensions

Q9: Derivatives are financial instruments that derive their

Q9: Which of the following calculations is used

Q10: The accumulated benefit obligation measures:

A) the pension

Q12: Falcon Networks Falcon Networks is a leading

Q18: A minimum liability for pension expense is

Q19: All of the following are conditions for

Q36: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents