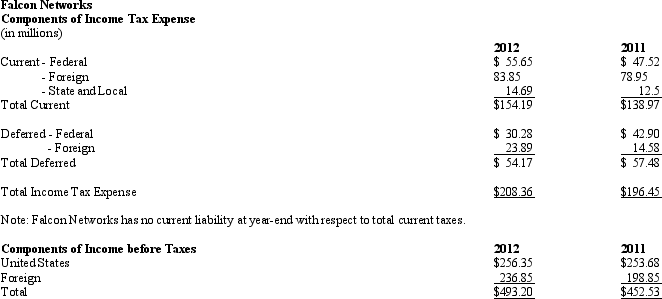

Falcon Networks Falcon Networks is a leading semiconductor company with operations in 17 different countries.Information about the company's taxes appears below: Using the information provided by Falcon Networks determine the foreign effective tax rate for 2012.

Using the information provided by Falcon Networks determine the foreign effective tax rate for 2012.

A) 33.52%

B) 35.00%

C) 42.25%

D) 45.49%

Correct Answer:

Verified

Q1: Presented below is pension information related to

Q1: To calculate a company's average tax rate

Q7: Gorilla,Corp.implemented a defined-benefit pension plan for its

Q7: The major difference between accounting for pensions

Q9: Derivatives are financial instruments that derive their

Q9: Which of the following calculations is used

Q10: The accumulated benefit obligation measures:

A) the pension

Q18: A minimum liability for pension expense is

Q19: All of the following are conditions for

Q36: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents