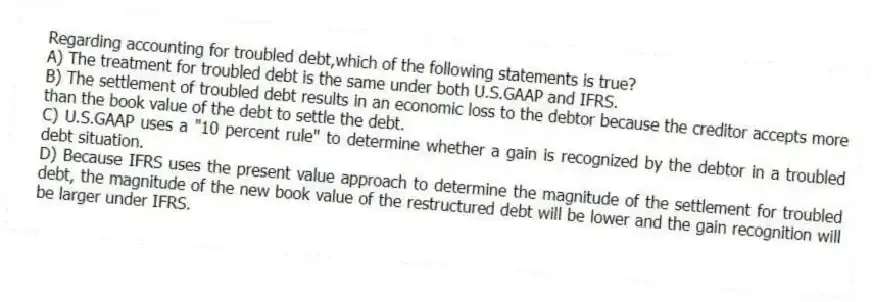

Regarding accounting for troubled debt,which of the following statements is true?

A) The treatment for troubled debt is the same under both U.S.GAAP and IFRS.

B) The settlement of troubled debt results in an economic loss to the debtor because the creditor accepts more than the book value of the debt to settle the debt.

C) U.S.GAAP uses a "10 percent rule" to determine whether a gain is recognized by the debtor in a troubled debt situation.

D) Because IFRS uses the present value approach to determine the magnitude of the settlement for troubled debt, the magnitude of the new book value of the restructured debt will be lower and the gain recognition will be larger under IFRS.

Correct Answer:

Verified

Q6: Which kind of dividend has an interest-bearing

Q7: Which kind of dividend typically pays dividends

Q8: Which is the date when employees elect

Q9: Under IFRS,cash payments for purchase of treasury

Q10: Which kind of dividend typically pays dividends

Q12: In some countries the account Reserve for

Q13: All of the following are benefits of

Q14: Financial reporting requires that firms recognize product

Q15: Which is the first date when employees

Q16: According to U.S.GAAP,which of the following provides

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents