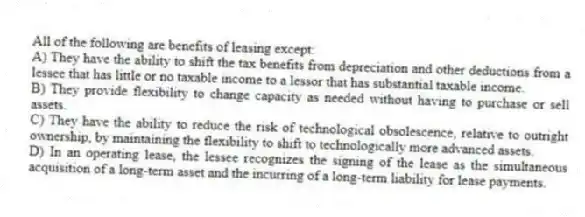

All of the following are benefits of leasing except:

A) They have the ability to shift the tax benefits from depreciation and other deductions from a lessee that has little or no taxable income to a lessor that has substantial taxable income.

B) They provide flexibility to change capacity as needed without having to purchase or sell assets.

C) They have the ability to reduce the risk of technological obsolescence, relative to outright ownership, by maintaining the flexibility to shift to technologically more advanced assets.

D) In an operating lease, the lessee recognizes the signing of the lease as the simultaneous acquisition of a long-term asset and the incurring of a long-term liability for lease payments.

Correct Answer:

Verified

Q8: Which is the date when employees elect

Q9: Under IFRS,cash payments for purchase of treasury

Q10: Which kind of dividend typically pays dividends

Q11: Regarding accounting for troubled debt,which of the

Q12: In some countries the account Reserve for

Q14: Financial reporting requires that firms recognize product

Q15: Which is the first date when employees

Q16: According to U.S.GAAP,which of the following provides

Q17: Which kind of dividend is a return

Q18: Under U.S.GAAP,which of the following items would

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents