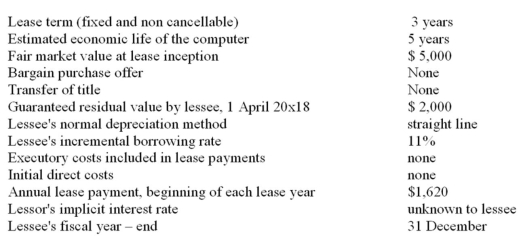

ABC Inc.leased a computer to the Lennox Silver Company on 1 April 2018.The terms of the lease are as follows:  *** ABC Inc.company charges a half-year depreciation in the year of acquisition and a half-year in the year of disposition,regardless of the actual dates of acquisition and disposal.

*** ABC Inc.company charges a half-year depreciation in the year of acquisition and a half-year in the year of disposition,regardless of the actual dates of acquisition and disposal.

From the above information classify the lease from the perspective of the lessee.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q210: Why is the gross method used by

Q212: The following information relates to a lease

Q214: What are the income tax implications for

Q215: A lessor leased equipment to a lessee

Q217: Lessor Company leases small computers on three-year

Q218: ABC Inc.leased a computer to the Lennox

Q219: This question relates to the different types

Q220: Over the life of a lease,ABC Inc.received

Q224: Lessor Company rented a machine to Lessee

Q233: LXR leased to LXE a computer that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents