Lessor Company leases small computers on three-year leases at the end of which the residual value is not material in amount.Rents are collected at year-end.On January 1,2014,Lessor signed a 3-year lease with Lessee Company that called for annual rents of $12,063,which was a return to Lessor of 10% on the $30,000 cost (market value at date of lease).Assume the lease qualifies as a direct financing lease to the lessor and a finance lease to the lessee.There was no bargain purchase option or residual value.The lessee's incremental borrowing rate is 12%.

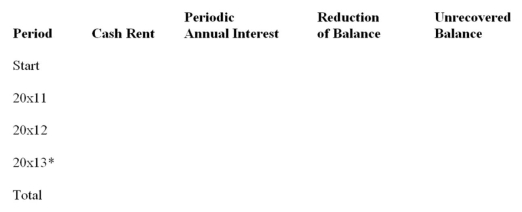

(a)Complete the following amortization schedule for the lease.

Round to the nearest dollar.  * May have slight rounding error.

* May have slight rounding error.

(b)Can both the lessor and lessee use the amortization schedule values in this instance?

Yes __________________ No ___________________

Explain why _________________________________________________.

(c)Give the entries for the lessor and lessee on the following dates (assume the accounting period ends December 31).Use the abbreviated account titles.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q210: Why is the gross method used by

Q212: The following information relates to a lease

Q215: A lessor leased equipment to a lessee

Q216: ABC Inc.leased a computer to the Lennox

Q218: ABC Inc.leased a computer to the Lennox

Q219: This question relates to the different types

Q220: Over the life of a lease,ABC Inc.received

Q222: Company X leased an asset to Y

Q224: Lessor Company rented a machine to Lessee

Q233: LXR leased to LXE a computer that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents