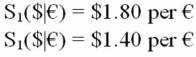

An American Hedge Fund is considering a one-year investment in an Italian government bond with a one-year maturity and a euro-denominated rate of return of i€ = 5%. The bond costs €1,000 today and will return €1,050 at the end of one year without risk. The current exchange rate is €1.00 = $1.50. U.S. dollar-denominated government bonds currently have a yield to maturity of 4%. Suppose that the European Central Bank is considering either tightening or loosening its monetary policy. It is widely believed that in one year there are only two possibilities:  Following revaluation, the exchange rate is expected to remain steady for at least another year.

Following revaluation, the exchange rate is expected to remain steady for at least another year.

-Find the NPV in dollars for the American firm if they wait one year to buy the bond after the exchange rate rises to S1($|€)= $1.80 per €.Assume that i€ doesn't change.

Correct Answer:

Verified

Q63: Consider the following international investment opportunity. It

Q65: Find the dollar cash flows to compute

Q70: What is the dollar-denominated IRR of this

Q81: Using your results to the last question,

Q83: The CFO who has a CFA notices

Q91: Find the IRR in dollars for the

Q92: Your banker quotes the euro-zone risk-free rate

Q96: Find the IRR in euro for the

Q97: Find the ex post IRR in euro

Q100: Using the notion of a hedge ratio,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents