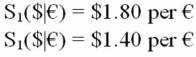

An American Hedge Fund is considering a one-year investment in an Italian government bond with a one-year maturity and a euro-denominated rate of return of i€ = 5%. The bond costs €1,000 today and will return €1,050 at the end of one year without risk. The current exchange rate is €1.00 = $1.50. U.S. dollar-denominated government bonds currently have a yield to maturity of 4%. Suppose that the European Central Bank is considering either tightening or loosening its monetary policy. It is widely believed that in one year there are only two possibilities:  Following revaluation, the exchange rate is expected to remain steady for at least another year.

Following revaluation, the exchange rate is expected to remain steady for at least another year.

-Find the IRR in dollars for the American firm if they wait one year to buy the bond after the exchange rate falls to S1($|€)= $1.40 per €.Assume that i€ doesn't change.

Correct Answer:

Verified

Q84: Your banker quotes the euro-zone risk-free rate

Q87: Compute the NPV at the current price

Q88: Compute the NPV at the two possible

Q93: Using your results to the last question,

Q94: Using the notion of hedging, make a

Q95: Find the NPV in euro for the

Q96: An American Hedge Fund is considering a

Q98: Find the NPV in euro for the

Q99: The hedge fund manager notices the optionality

Q102: Estimate the value of the option on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents