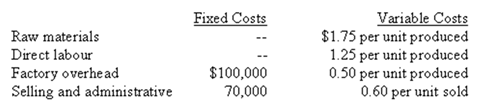

Indiana Corporation produces a single product that it sells for $9 per unit.During the first year of operations,100,000 units were produced and 90,000 units were sold.Manufacturing costs and selling and administrative expenses for the year were as follows:

What was Indiana Corporation's operating income for the year using variable costing?

A) $181,000.

B) $271,000.

C) $281,000.

D) $371,000.

Correct Answer:

Verified

Q1: Under variable costing,which of the following costs

Q2: Which of the following costs/expenses is included

Q4: Which of the following are considered to

Q5: Which of the following are considered to

Q7: The total fixed manufacturing overhead costs of

Q7: Which of the following statements is true

Q9: During the most recent year,Evans Company had

Q10: During the year just ended,Roberts Company's operating

Q15: Which of the following is normally included

Q16: Operating income determined using absorption costing can

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents