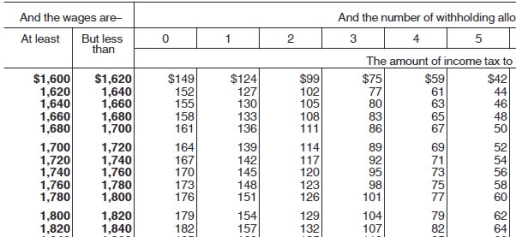

Trish earned $1,734.90 during the most recent semimonthly pay period.She is married and has 3 withholding allowances.Based on the following table,how much should be withheld from her gross pay for Federal income tax?

A) $92.00

B) $89.00

C) $95.00

D) $69.00

Correct Answer:

Verified

Q21: According to the Consumer Credit Protection Act,what

Q21: Renee is a salaried exempt employee who

Q23: Disposable income is defined as:

A)An employee's net

Q26: Warren is a married employee with

Q27: Caroljane earned $1,120 during the most recent

Q29: Andie earned $680.20 during the most recent

Q30: Ross is a full-time employee who earns

Q33: Max earned $1,019.55 during the most recent

Q34: Jeannie is an adjunct faculty at a

Q36: Julio is single with 1 withholding allowance.He

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents