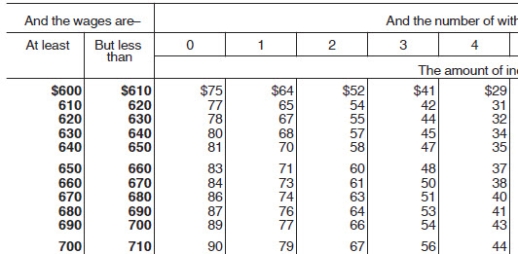

Andie earned $680.20 during the most recent weekly pay period.She is single with 3 withholding allowances and needs to decide between contributing 2.5% and $25 to her 401(k) plan.If she chooses the method that results in the lowest taxable income,how much will be withheld for Federal income tax (based on the following table) ?

A) $58.00

B) $60.00

C) $48.00

D) $47.00

Correct Answer:

Verified

Q21: According to the Consumer Credit Protection Act,what

Q23: Disposable income is defined as:

A)An employee's net

Q24: Melody is a full-time employee who earns

Q25: Olga earned $1,558.00 during the most

Q26: Warren is a married employee with

Q27: Caroljane earned $1,120 during the most recent

Q30: Ross is a full-time employee who earns

Q31: Trish earned $1,734.90 during the most recent

Q33: Max earned $1,019.55 during the most recent

Q34: Jeannie is an adjunct faculty at a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents