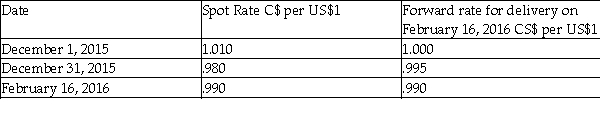

On December 1,2015,Mackenzie Mann Ltd.entered into a binding agreement to buy inventory costing US$300,000 for delivery on February 16,2016.Terms of the sale were COD (cash on delivery).Mackenzie Mann,which has a December 31 year-end,decided to hedge its foreign exchange risk and entered into a forward agreement to receive US$300,000 at that time.Mackenzie Mann designated the forward a fair value hedge.Pertinent exchange rates follow:

Required:

Record the required journal entries for December 1,December 31,and February 16 using the net method.If no entries are required,state "no entry required" and indicate why.

Correct Answer:

Verified

Q66: Which statement is correct about the accounting

Q82: Which method must be used under ASPE

Q84: Explain what a "fair value" and "cash

Q85: What is a "hedge"?

A)A financial instrument that

Q87: Which statement is correct about hedge accounting?

A)Hedge

Q92: Give 4 examples of cash flow hedges:

Q93: Breezy Lodge issued 25,000 at-the-money stock options

Q97: Identify the type of hedge under each

Q98: Windy Lake Lodge issued 24,000 at-the-money stock

Q99: Price Farms granted 290,000 stock options to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents