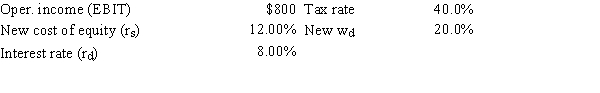

As a consultant to First Responder Inc.,you have obtained the following data (dollars in millions) .The company plans to pay out all of its earnings as dividends,hence g = 0.Also,no net new investment in operating capital is needed because growth is zero.The CFO believes that a move from zero debt to 20.0% debt would cause the cost of equity to increase from 10.0% to 12.0%,and the interest rate on the new debt would be 8.0%.What would the firm's total market value be if it makes this change? Hints: Find the FCF,which is equal to NOPAT = EBIT(1 − T) because no new operating capital is needed,and then divide by (WACC − g) .

A) $2,982

B) $3,314

C) $3,682

D) $4,091

E) $4,545

Correct Answer:

Verified

Q76: Firms HD and LD are identical except

Q77: Firm A is very aggressive in its

Q78: Your uncle is considering investing in a

Q78: Which of the following statements is CORRECT?

A)

Q79: Gator Fabrics Inc.currently has zero debt .It

Q81: Your firm's debt ratio is only 5.00%,but

Q82: Dye Industries currently uses no debt,but its

Q83: You were hired as the CFO of

Q84: You have been hired by a new

Q85: Monroe Inc.is an all-equity firm with 500,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents