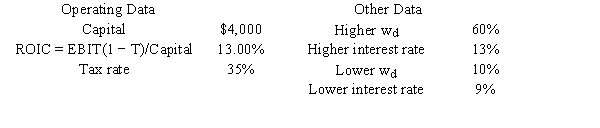

You have been hired by a new firm that is just being started.The CFO wants to finance with 60% debt,but the president thinks it would be better to hold the percentage of debt in the capital structure (wd) to only 10%.Other things held constant,and based on the data below,if the firm uses more debt,by how much would the ROE change,i.e.,what is ROENew − ROEOld?

A) 5.44%

B) 5.73%

C) 6.03%

D) 6.33%

E) 6.65%

Correct Answer:

Verified

Q78: Your uncle is considering investing in a

Q79: Gator Fabrics Inc.currently has zero debt .It

Q80: As a consultant to First Responder Inc.,you

Q81: Your firm's debt ratio is only 5.00%,but

Q82: Dye Industries currently uses no debt,but its

Q83: You were hired as the CFO of

Q85: Monroe Inc.is an all-equity firm with 500,000

Q86: Southeast U's campus book store sells course

Q87: Your girlfriend plans to start a new

Q88: Dyson Inc.currently finances with 20.0% debt (i.e.,wd

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents